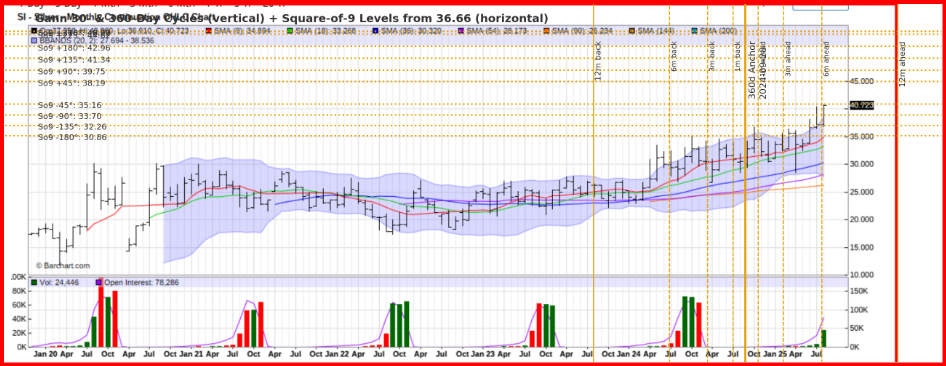

Silver Futures – Monthly Special Report with Gann Cycles

& Square-of-9

GDX Mean Reversion Trading

Date: August 30, 2025,

Prepared by: Patrick MontesDeOca

Target Audience: Gold Market Analysts, Traders, and Investors

Price Action

Silver closed the month at $40.72, after printing a high of $40.86, a low of $36.91, and an open of $37.25. Price is hugging the upper Bollinger Band (currently at $38.54), which underscores the strength of the current rally but also signals short-term overextension. Importantly, Silver has broken out of the prolonged consolidation range between $22–$30 that dominated 2020–2023, and is now trading at multi-year highs. This structural breakout marks a decisive shift into a new bullish phase.

Moving Averages

- SMA (18): 33.27

- SMA (20): 34.89

- SMA (36): 30.32

- SMA (54): 28.17

- SMA (90): 26.23

- SMA (144) & SMA (200): mid-20s

All short-, medium-, and long-term moving averages are sloping upward. The price remains well above every key average, reflecting a robust bullish structure that is fully supported across multiple timeframes.

Technical Indicators

- Bollinger Bands: Price is pressing against the upper band, reflecting both strength and short-term overbought conditions.

- Volume: 24K, moderate.

- Open Interest: 78K, steady and non-speculative.

Historically, volume spikes at peaks have preceded corrections. Traders should watch for similar signals as Silver tests the $41–$42 zone.

Gann Cycles

Using September 28, 2024 as a 360-day anchor point, the next major timing windows fall into late December 2024, March 2025, and September 2025. These align with 30-day and 90-day subdivisions of the larger annual cycle, often coinciding with turning points. The present rally into $41–$42 is converging with the September-October 2025 window, reinforcing the probability of a corrective pause before higher highs.

Square-of-9 Harmonics

From a 36.66 base, current trade at $40.72 sits between the +90° level at $39.75 and the +135° harmonic at $41.34. This cluster defines a mean-reversion resistance band.

- A breakout above $41.34 opens targets at $42.96 (+180°) and $44.62 (+225°).

- Failure to hold $39.75 points to pullbacks toward $38.19 (+45°) or deeper into $35.16 (–45°).

Trend Outlook

The breakout above $35–$36 resistance confirms a long-term bull market.

- Immediate resistance: $41–$42 (Square-of-9 + multi-year high).

- Support: $37.50 (monthly open) and $35.00 (prior breakout zone).

So long as price holds above $36–$37 on a monthly closing basis, the technical and cyclical structure supports continuation toward $45+ in coming months. Mean-reversion dips into the $37–$38 band should be viewed as accumulation opportunities within the broader bullish framework.

Summary in One Line:

Silver’s bullish breakout is now reinforced by Gann cycle timing and Square-of-9 harmonics, with $41–$42 as a pivotal resistance zone. A sustained breakout above $41.34 projects targets toward $45, while mean-reversion pullbacks into $37–$38 remain buyable within a strong long-term uptrend.

TRADING DERIVATIVES, FINANCIAL INSTRUMENTS AND PRECIOUS METALS INVOLVES SIGNIFICANT RISK OF LOSS AND IS NOT SUITABLE FOR EVERYONE. PAST PERFORMANCE IS NOT NECESSARILY INDICATIVE OF FUTURE RESULTS.