Gold Futures Monthly Special Report – Cycle & Geometry

Convergence

GDX Mean Reversion Trading

Date: August 30, 2025,

Prepared by: Patrick MontesDeOca

Target Audience: Gold Market Analysts, Traders, and Investors

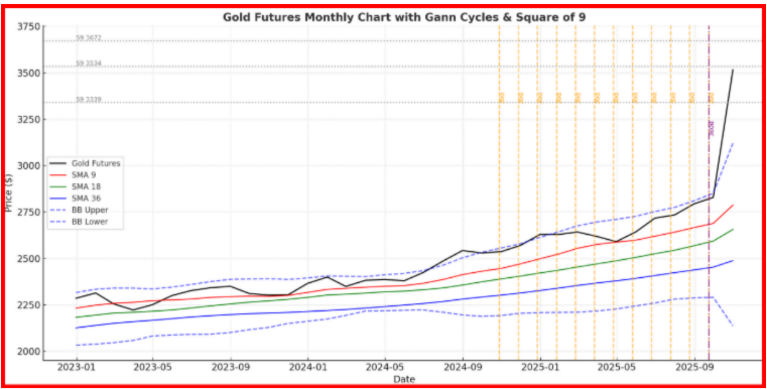

Gold futures are trading at $3,516.1, having just tested a new high of $3,534.2. This rally

extends a parabolic advance that began after the breakout above the $2,200 consolidation band

in 2023. The momentum of this run is extraordinary, but when measured against cyclical and

geometric frameworks, the market is approaching a highly sensitive inflection zone.

Long-Term Structure

The monthly chart confirms a secular bull market in full force. The 9-month SMA ($3,207) and

18-month SMA ($2,932) are steeply ascending, layered well above the 36-month ($2,617) and

54-month ($2,402) averages. This bullish alignment is textbook. However, the price now stands

nearly 10% above the 9-month average and over 30% above the 36-month mean, placing it

in an extended condition.

The Bollinger Band framework reinforces this: gold is currently pressing against the upper band

at $3,567.8, an area where mean reversion has historically occurred.

Gann Cycle Analysis

● 30-Day Cycle: The short-term 30-day Gann rhythm projects pivot dates into late

September to early October 2025, aligning with the immediate advance. This suggests

that while upside pressure could persist into early fall, topping behavior is likely within

that window.

● 360-Day Cycle: Anchored from the September 28, 2024 low, the full 360-day rotation

points to August 28, 2025 as a critical high-probability turning point. The fact that gold

has surged into this cycle window with prices testing upper Bollinger resistance

strengthens the case for corrective activity.

Square of 9 Geometry

Applying the Square of 9, the $3,534 high resonates closely with key harmonic rotations off the

$1,618 Fibonacci base pivot and prior highs at $2,070 and $2,350. This geometric alignment

underscores the probability of a time/price convergence, often a precursor to reversal or at

least consolidation phases.

Market Implications

The combination of cycle maturity (30-day topping phase, 360-day climax), geometric resistance

($3,534 zone), and volatility band extension ($3,567) creates a confluence of signals that

suggests gold is at or near a short-term cyclical peak. While the secular bull trend remains

intact, probability favors a mean reversion retracement toward $3,200–$3,000, which aligns

with the 9- and 18-month averages.

Conclusion

Gold’s long-term bull phase is undeniable, yet the cyclical and geometric evidence argues

strongly for caution. For traders, this is a moment to scale profits into strength and prepare for

a pullback that should ultimately reset the trend, offering renewed entry opportunities.

TRADING DERIVATIVES, FINANCIAL INSTRUMENTS AND PRECIOUS METALS

INVOLVES SIGNIFICANT RISK OF LOSS AND IS NOT SUITABLE FOR EVERYONE.

PAST PERFORMANCE IS NOT NECESSARILY INDICATIVE OF FUTURE RESULTS.